buy that high-interest-rate currency as well, knowing that there is likely to be

massive buying interest for that currency

the Bank of Japan has no intention to raise rates in Japan, there is bound to be more

buying interest for USD/JPY, thus pushing up the US dollar against the Japanese

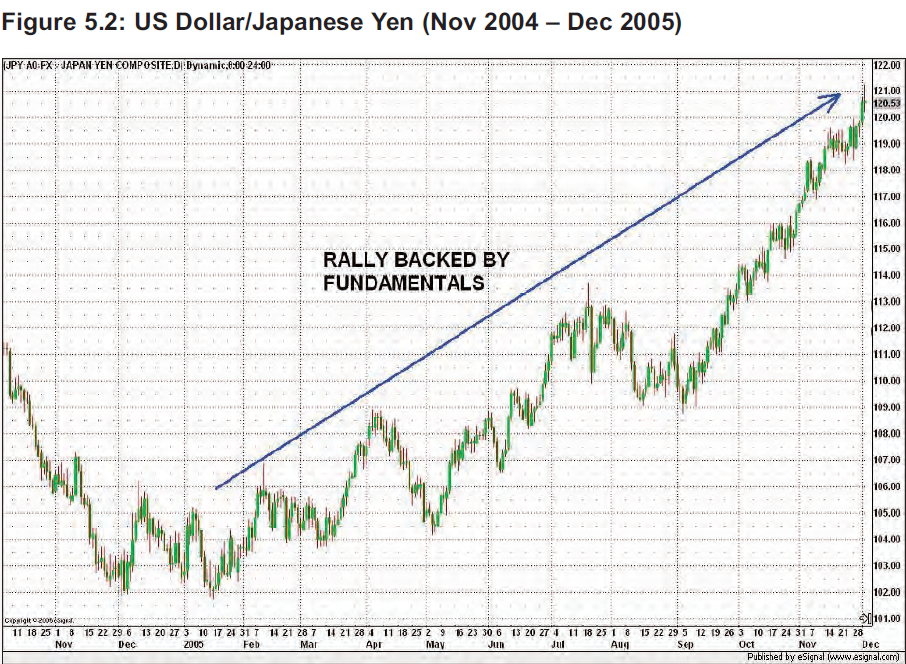

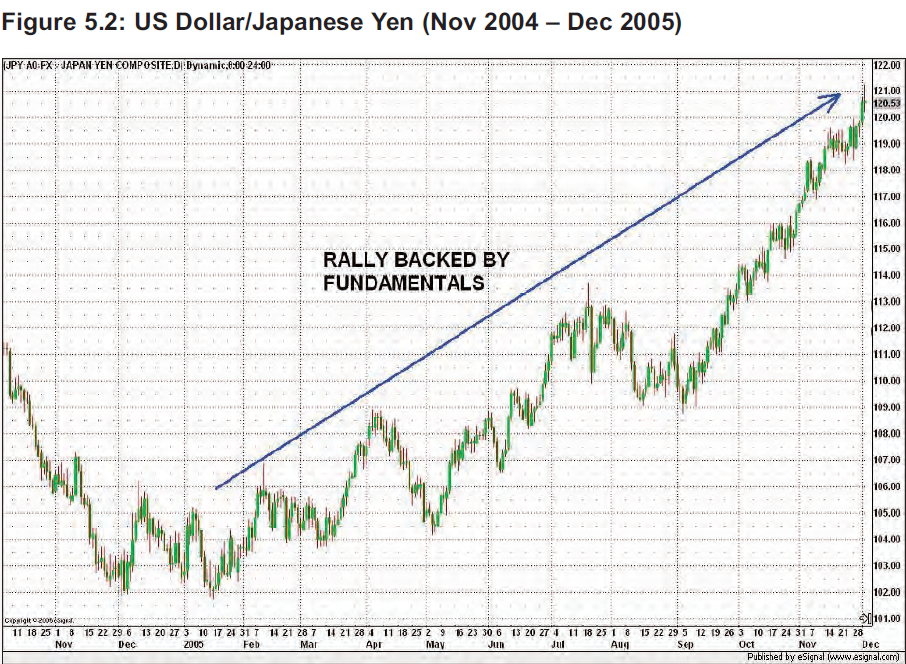

yen, and even possibly against other currencies as well. This situation occurred in

2005, which caused USD/JPY to rally around 1900 pips from the start of the year

to December 2005, as you can see from Figure 5.2. This divergence in monetary

policy between the US and Japan had created a very bullish US dollar sentiment in

the market, attracting more and more traders to long USD/JPY

regarding the currency of that country

The opposite is true too: when interest rates are cut in a country, that would result

in quite a bearish sentiment regarding the currency of that country, and traders

.would be more willing to sell than buy that particular currency

FX-Arabia

|

|

جديد المواضيع |

لوحة التحكم

روابط هامة

|

||||||

| منتدى تعليم الفوركس يحتوى المنتدى التعليمى على العديد من المراجع و الكتب و المؤلفات التى تساهم فى تعليم المضاربين اصول و فنون تداول العملات (الفوركس) منتدى الفوركس ، المواد التعليمية ل سوق الفوركس ، دروس ، تحيلي رقمى ، كتب ، مقالات تعليمية ، دورات فوركس مجانية ، تعليم تحليل فني ، تحليل اساسي ، موجات اليوت ، فيبوناتشي ، تعليم فوركس ، برامج التداول ، تعليم الفوركس بالفيديو ، شروحات . تعلم الفوركس , تعليم الفوركس , فيديو فوركس , افضل دورة فوركس , دورة فوركس مجانية , دورة فوركس , ربح فوركس , استراتيجية فوركس , فيديو فوركس تعليمى , فيديو فوركس و الكثير. |

|

|

|

أدوات الموضوع |

|

|

المشاركة رقم: 11 | ||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

When forex traders anticipate this kind of situation, they become more inclined to For example, if the Fed announces a series of interest rate hikes in the US, whereas So, in general, rising interest rates in a country should boost the market sentiment

|

||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

#11

|

|

|

|

|

When forex traders anticipate this kind of situation, they become more inclined to buy that high-interest-rate currency as well, knowing that there is likely to be massive buying interest for that currency For example, if the Fed announces a series of interest rate hikes in the US, whereas the Bank of Japan has no intention to raise rates in Japan, there is bound to be more buying interest for USD/JPY, thus pushing up the US dollar against the Japanese yen, and even possibly against other currencies as well. This situation occurred in 2005, which caused USD/JPY to rally around 1900 pips from the start of the year to December 2005, as you can see from Figure 5.2. This divergence in monetary policy between the US and Japan had created a very bullish US dollar sentiment in the market, attracting more and more traders to long USD/JPY  So, in general, rising interest rates in a country should boost the market sentiment regarding the currency of that country The opposite is true too: when interest rates are cut in a country, that would result in quite a bearish sentiment regarding the currency of that country, and traders .would be more willing to sell than buy that particular currency |

|

|

المشاركة رقم: 12 | ||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

|

||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

#12

|

|

|

|

|

Economic growth Besides interest rates, economic growth of countries can also have a big impact on the overall currency market sentiment Since the United States has the largest economy in the world, the US economy is a key factor in determining the overall market sentiment, especially of currency pairs that have the USD component. A robust economic expansion, coupled with a healthy labour market, tends to boost consumer spending in that country, and this helps companies and businesses to flourish. A country with a strong economy is in a better position to attract more overseas investments into the country, as investors .generally prefer to invest in a solid economy that is growing at a steady pace Investments pouring into a country requires the currency of that country to be bought in exchange of other currencies; this increased demand for that country’s currency should cause that currency to strengthen against other currencies. Forex traders, expecting this consequence, will put on their bullish cap to buy that currency before the investors do :Some of the most important indicators of a country’s economic growth include 1Gross Domestic Product (GDP 2the unemployment rate, and 3trade balance data These are explained below |

|

|

المشاركة رقم: 13 | ||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

|

||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

#13

|

|

|

|

|

1GDP The GDP measures the total value of all goods and services that are originated from the country; the GDP figure indicates the rate of the country’s expansion or contraction based on output and growth. A healthy GDP figure usually adds bullish sentiment to the currency of that country, especially if it exceeds the market’s expectations 2Unemployment rate The unemployment data reports the state of the labour market of a country. The lower the unemployment rate, the more positive it is for the country’s economy, and hence its currency, as consumers would feel more confident about spending if they have jobs, and that would eventually impact on companies and businesses in the country, generating more output 3Trade balance data Another widely watched economic indicator is the trade balance data. Trade balance measures the difference between the value of imports and exports of goods and services of a country. If a country exports more than it imports, it has a trade surplus. If imports exceed exports, then the country will end up with a trade deficit which does not bode well for that country’s currency because that currency has to be sold to buy other foreign currencies in order to pay for those imported goods and services For example, if the US imports an increased amount of goods and services from Europe, US dollars will have to be sold in exchange to buy euros to pay for those imports. The resulting outflow of US dollars from the United States could potentially cause a depreciation of the US dollar against the euro or other currencies, and that can affect market sentiment surrounding the USD. The opposite scenario is true for a country that is experiencing a trade surplus. However market sentiment of a currency can still be bullish despite that country having a trade deficit, as the net amount of trade deficit could be covered by an equivalent or greater amount of capital investment pouring into that country, and thus would not be a cause for concern Geopolitical risks Geopolitical risk refers to the risk of a country’s foreign or domestic policy affecting domestic social and political stability in another country or regional zone Global geopolitical uncertainties such as terrorism, transitional change of government or nuclear threats can cause investors to lose faith in some particular currencies, and they may prefer to shift their assets into a safe haven currency when these circumstances arise. Market sentiment is very sensitive to such geopolitical developments, and can cause a strong bias towards a particular currency For example, during periods of high tension in the Middle East in 2006, the market formed a very bullish sentiment towards the US dollar, which became the preferred currency to hold in such turbulent times, replacing the traditional status of the Swiss franc as the safe haven currency. Forex traders should be keenly aware of the current geopolitical environment in order to keep track of any potential change in market sentiment, which could impact currency prices |

|

|

المشاركة رقم: 14 | ||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

|

||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

#14

|

|

|

|

|

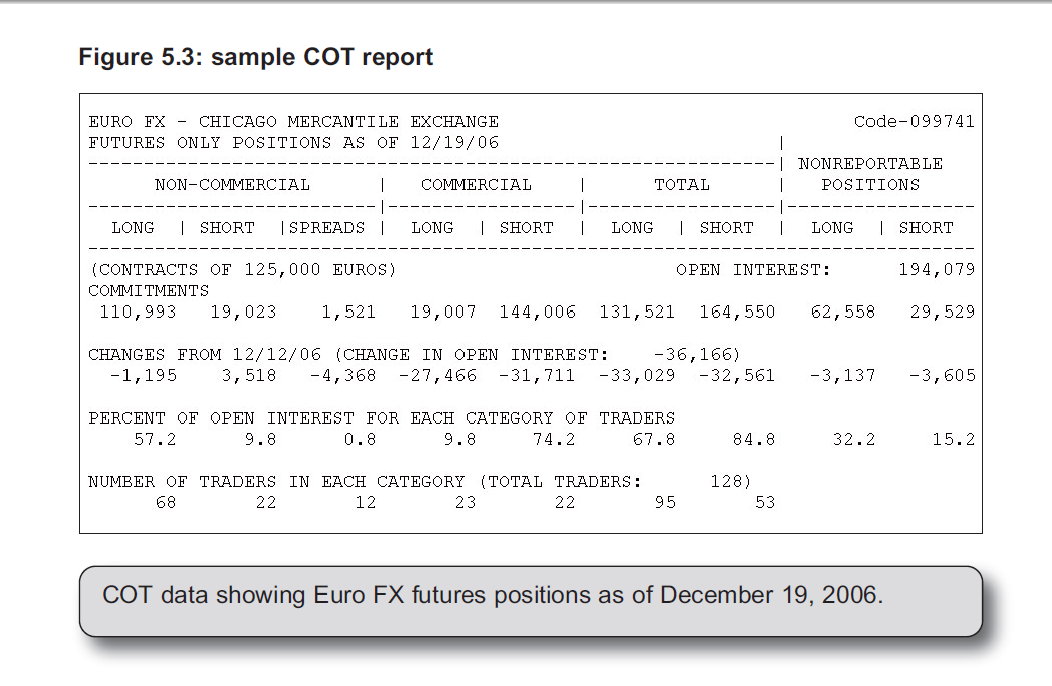

Ways of Measuring Market Sentiment The mood of the market depends mainly on what the majority of traders think about the current market situation. But how can you get an idea of the overall sentiment of the market? You can do so by reading reports by analysts and financial journalists in news wires or by visiting online trading forums to see what other traders are discussing. However, these ways of getting a feel of the current market sentiment are not too accurate; you may think that other traders are in a buying or selling mood, but that may not be what is really happening in reality. Here are some :of the more effective ways of gauging market sentiment 1The Commitment of Traders (COT) report 2The market’s reactions to news releases These are explained in more details below 1Commitment Of Traders (COT) report ?What is the COT The COT report provides traders with detailed positioning information about the futures market, and is, in my opinion, one of the most underrated tools that forex traders can make use of to enhance their trading performance The report is compiled and released weekly by the Commodity Futures Trading Commission (CFTC) in the United States every Friday at 15:30 Eastern Time, and records open interest information about the futures market based on the previous Tuesday. Anyone can access the COT report for free on the CFTC website (www.cftc.gov/cftc/cftccotreports.htm) There are basically two types of reports available: the futures-only COT report and the futures-and-options-combined COT report. I usually just access the futuresonly report for a glimpse of what has happened in the futures dimension of the forex market. In order to get through to the currency futures data, you have to wade past other commodities like milk, feeder cattle and so on, so a little patience is required Even though the data arrives three days late, the information nonetheless can be helpful since many traders spend their weekend analyzing the COT report. The time lag between reporting and release is the main handicap of the COT data, but despite this limitation, you can still use it as a sentiment tool (Figure 5.3 shows a page from the December 19, 2006, COT report (short format displaying data for the Chicago Mercantile Exchange’s Euro FX futures contract You can see the long and short positions held by traders in each of the three main categories defined by the CFTC, as explained below  يتبع.. |

|

|

المشاركة رقم: 15 | ||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

|

||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

#15

|

|

|

|

|

Commercial This group consists of market participants who use the futures contracts for hedging purposes, and these commercial participants are generally exporters and importers who are hedging against currency fluctuations. For example, a German car-maker, who exports to the US, expects to receive 10 million euros worth of sales within the next quarter. To hedge against the possibility of a US dollar decline which would affect the amount of euros it would receive once converted the German car-maker would short 10 million in Euro FX futures. On the other hand, if a US car manufacturer exports 10 million US dollars worth of cars within the next quarter, it would long the equivalent in Euro FX futures contracts Non-commercial This group consists of large speculators such as hedge funds, banks and so on who use currency futures just for speculation Non-reportable .This group consists of small speculators like retail traders The COT report tells you the long and short positions undertaken by participants from each category.When it comes to analyzing information pertaining to currency futures in the COT report, it is generally more relevant for traders to focus on the noncommercial participants rather than on the commercial participants. The reason behind this is that these large speculators trade the futures contractsmainly for profits and do not have the intention to take delivery of the underlying asset, which in this case would be cash. On the other hand, commercial participants tend to maintain and roll over the same amount of contracts from month to month for hedging purposes even though these positions could be in losses. Large speculators, however, will .usually close their losing positions instead of rolling them over to the next month ?Why use The COT The COT report allows you to gauge market sentiment in the currency futures market, which also influences the spot forex market. Currency futures are basically spot prices which are adjusted by the forwards (derived by interest rate differentials) to arrive at a future delivery price. Unlike spot forex which does not have a centralised exchange at the time of writing, currency futures are cleared at the Chicago Mercantile Exchange Price quotation One of the many differences between spot forex and currency futures lies in their quoting convention. In the currency futures market, currency futures are mostly quoted as the foreign currency directly against the US dollar. For example, Swiss francs are quoted versus the US dollar in futures, unlike the USD/CHF notation in the spot forex market. So if the Swiss franc falls in value against the US dollar USD/CHF will rise, and the Swiss franc futures will fall. On the other hand EUR/USD in spot forex is quoted in the same way as Euro futures, so if the Euro .appreciates in value, Euro futures will rise just like EUR/USD will go up That said, spot forex and currency futures do have one similarity: the spot and futures prices of a currency tend to move in tandem. When either the spot or futures price of a currency rises, the other also tends to rise, and when either falls, the other also tends to fall. For example, if the GBP futures price goes up, spot GBP/USD goes up (because GBP gains in strength). However, if the CHF futures price goes up, spot USD/CHF goes down (because CHF gains in strength), as both the spot and futures prices of CHF move in tandem |

|

|

المشاركة رقم: 16 | ||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

|

||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

#16

|

|

|

|

|

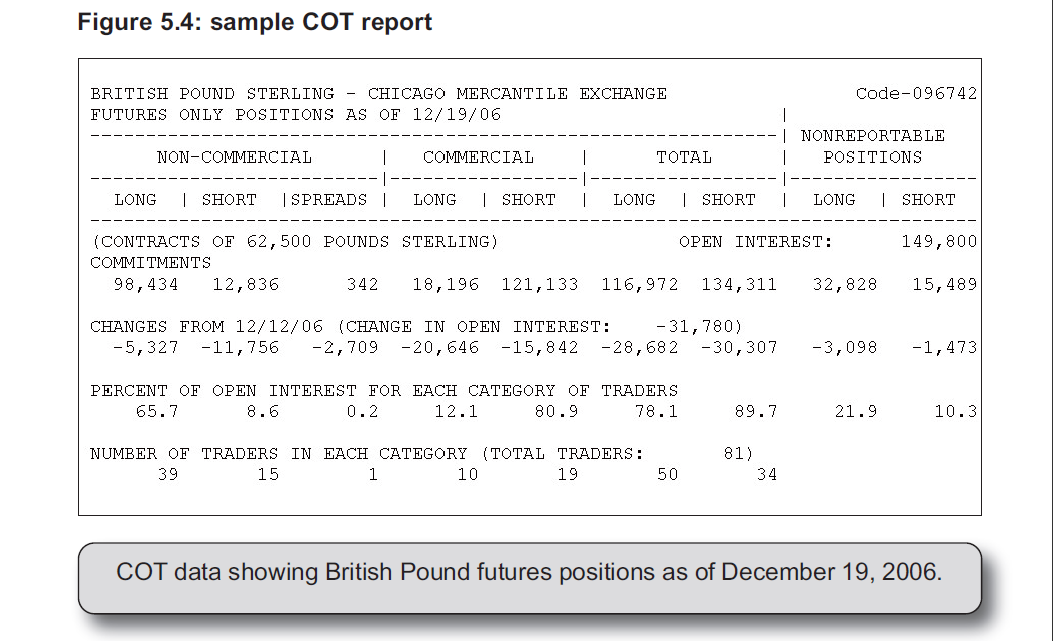

Using extreme positioning In the COT report, under each type of currency futures, you can see that the total contract volume in each category is split up between “long”, “short” and “spreads” of which the first two are relevant to our analysis. What is of concern to us is whether the non-commercials are net long or short in that currency futures In order to determine the volume of contracts that these large speculators are holding net long or short positions of for that particular currency futures, you just need to calculate the difference between the longs and shorts, that is, subtract the number of short contracts from the number of long contracts. A positive figure shows the number of net long contracts, while a negative figure shows the number of net short contracts As you can see in Figure 5.4, the open interest for GBP futures on Tuesday December 19, 2006, was 149,800 contracts which was a decrease of 31,780 contracts from the previous week. The non-commercials are long 98,434 contracts and short 12,836 (contracts. Therefore, they are overall net long 85,598 contracts (98434 - 12836  |

|

|

المشاركة رقم: 17 | ||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

|

||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

#17

|

|

|

|

|

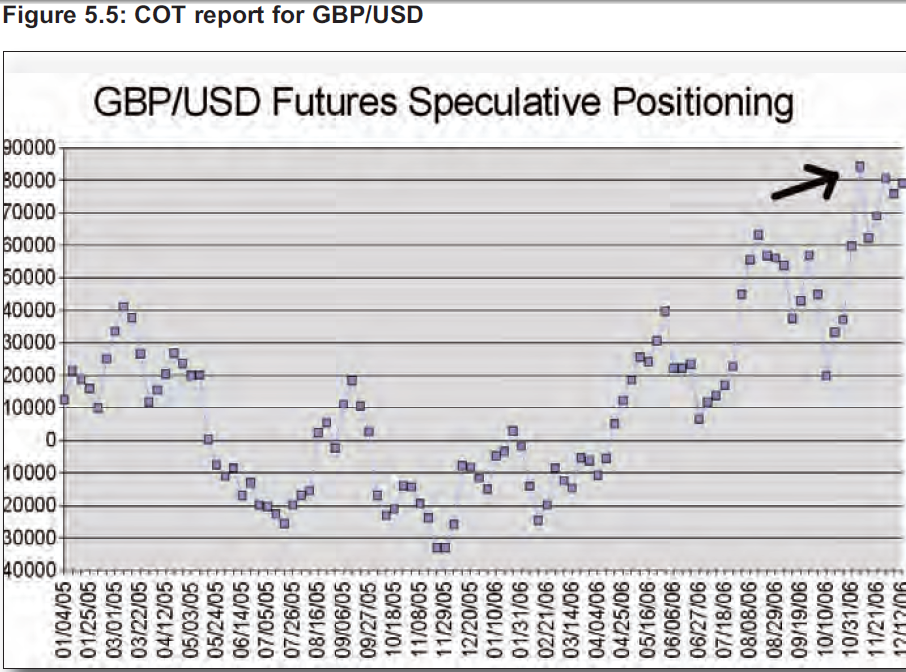

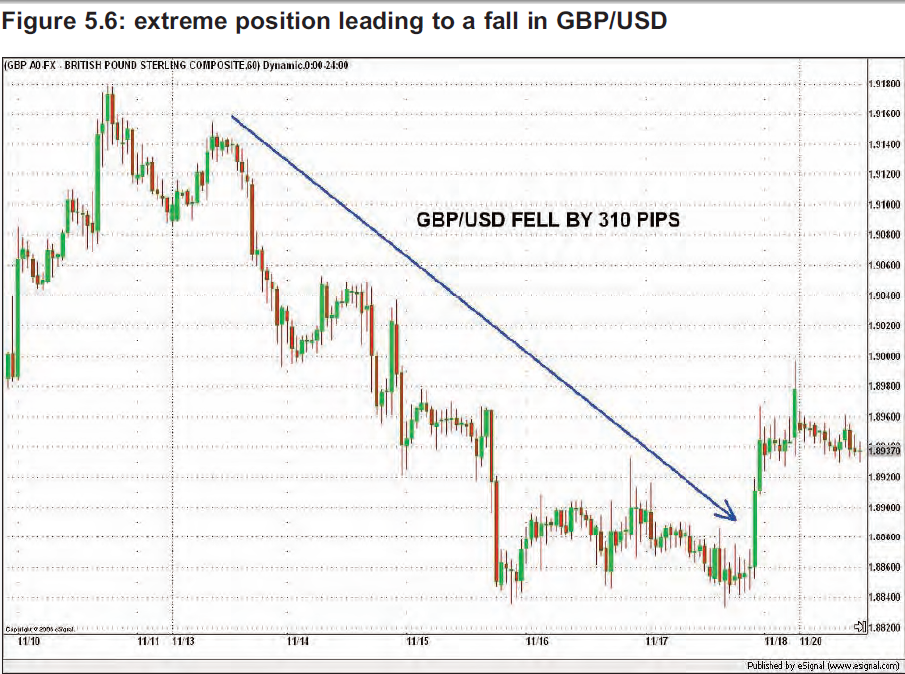

Usually, when a particular currency is trending up against the US dollar, the noncommercials tend to register a net long position since these large speculators tend to ride on the existing trend. The opposite situation is true too: the non-commercials tend to register a net short position when a particular currency is trending down against the US dollar. Knowing whether this category has been net long or short a few days ago only indicates to us the positioning in retrospect; this information is only useful if you compare the latest net positioning with the positioning figures from the past few weeks or months By comparing the latest net positioning with that of the past few weeks or months you can tell if the latest net long or net short positioning is skewing towards an extreme reading. My observation of the financial markets is that dramatic price moves, usually at major turning points, tend to occur when the majority of the market is positioned incorrectly. And since the large speculators are more inclined to close their losing positions than the commercial hedgers, it is beneficial for us to keep an eye on their net directional positioning as well as their net contract volume in the currency futures market. If these large non-commercials are positioned on the wrong side of the market, you can expect liquidation of these positions, with the extent of liquidation depending on the total volume of contracts traded in the wrong direction For example, if these large funds are holding large (extreme) net long GBP positions, but GBP is declining against the US dollar due to some external catalysts like news, they will eventually have to close their longs when their stops are triggered, or decide to close their longs before getting stopped out and switch to shorting GBP on the way down. Such mass unwinding of positions tends to bring about a powerful price move in the opposite direction which could last for a few days, and it is this turning point that you could detect with the COT data before the reversal scene actually plays out Example: COT – using extreme position 17,2006-An example of this was played out in the week through November 13 . The COT report that was released on November 10 showed that, as of the previous Tuesday on November 7, large speculative funds upped their net GBP longs to a multi-year high of +84,280 contracts, a figure which clearly shows up as an extreme positioning on the chart as shown in Figure 5.5 In this case, all those who had the intention to go long on GBP had already done so. As a result of this extreme net speculative positioning of GBP longs on the CME, GBP/USD in the spot market proceeded to decline by more than 300 pips in the following week .through November 13-17, 2006 (Figure 5.6  This chart shows the net speculative ( non-commercial) positions in GBP futures on the CME. X-axis displays the dates for every three weeks even though the data for every week is shown on the chart. Y-axis displays the net number of speculative contracts. Positive numbers indicate net long positioning, while negative numbers indicate net short positioning |

|

|

المشاركة رقم: 18 | ||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

|

||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

#18

|

|

|

|

In the week following the extreme net long speculative positioning, reflected by the COT data, GBP/USD fell by 310 pips as seen on this 60-min chart The presence of an extreme reading allows you to be prepared for a possible trend reversal which could occur when large speculators liquidate their positions. A mere increase or decrease of contracts for a particular currency futures does not indicate anything which could be of predictive value, as it simply shows you what has happened, but not what could possibly happen in a high-probability scenario COT data is a diamond in the rough What deters many traders from using the COT report is its raw organisation of data but that is not good enough an excuse to completely neglect this little treasure trove The information from the COT report can be transferred into a spreadsheet so that further analysis can be conducted in a more suitable format The COT data itself is not sufficient to generate entry or exit signals, as the report does not consist of currency price data, but it can generate warning signals of a possible turn ahead in the spot forex market, and can be used to optimise other trading strategies you may have so that maximum profits can be reaped from the market. Analysis of the COT report does not always throw up trading opportunities in the spot forex market, but when it does, you will be better prepared for a potential turn of tide, and be more confident in your trades. Even though entries and exits cannot be timed solely based on the COT data, it can be an extremely useful .tool to have in your toolbox to gauge the overall market sentiment 2Market’s reactions to news يتبع.. |

|

|

المشاركة رقم: 19 | ||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

وأنا ايضا على يقين ...خصوصا بعد قراءة المشاركات الأخيرة ... الموضوع يعرفنا كيف يفكر ويتصرف ويتاجر صناع السوق وكيفية اللحاق بهم ... موضوع ممتاز .

|

||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||

|

#19

|

|

|

|

|

وأنا ايضا على يقين ...خصوصا بعد قراءة المشاركات الأخيرة ... الموضوع يعرفنا كيف يفكر ويتصرف ويتاجر صناع السوق وكيفية اللحاق بهم ... موضوع ممتاز .

|

|

|

المشاركة رقم: 20 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

كاتب الموضوع :

abdellatif

المنتدى :

منتدى تعليم الفوركس

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

#20

|

|||||||||||||||||||||

|

|||||||||||||||||||||

ممتاز و فوق الممتاز ياهندسة..سنتطرق بكثرة لحركة صناع السوق الماكرين و في الفقرات القادمة سنتابع كيف يعملون ليربحو من جيوب المتداولين من خلال الكسر الوهمي للترندات و الدعوم و المقاومات..صناع السوق فعلا ماكرين في متاجرتهم.. |

|||||||||||||||||||||

|

| مواقع النشر (المفضلة) |

| الكلمات الدلالية (Tags) |

| stratgies, winning |

|

|