و لكن اخي من اين تاتي بالتوصيات يرجى وضع روابط

FX-Arabia

|

|

جديد المواضيع |

لوحة التحكم

روابط هامة

|

||||||

| منتدى تداول العملات العالمية العام (الفوركس) Forex منتدى العملات العام Forex فى هذا القسم يتم مناقشه كل ما يتعلق بـسوق تداول العملات العالمية الفوركس و مناقشة طرق التحليل المختلفة و تحليل المعادن , الذهب ، الفضة ، البترول من خلال تحليل فني ، تحليل اساسي ،اخبار اقتصادية متجددة ، تحليل رقمى ، مسابقات متعددة ، توصيات ، تحليلات ، التداول ، استراتيجيات مختلفة ، توصيات فوركس ، بورصة العملات ، الفوركس ، تجارة الفوركس ، يورو دولار ، باوند دولار ، بونص فوركس ، تداول ، اسهم ، عملات ، افضل موقع فوركس |

|

|

|

أدوات الموضوع |

|

|

المشاركة رقم: 261 | ||||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||

|

#261

|

|

|

|

|

و لكن اخي من اين تاتي بالتوصيات يرجى وضع روابط

|

|

|

المشاركة رقم: 262 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

جميع المشاركات هنا من مواقع البنوك مباشرة و هى تتطلب الاشتراك و تسجيل الدخول رابط موقع الدراسات و الابحاث و خدمات كبار المستثمرين من بنك بى ان باريبا Login / Register بعد تسجيل الدخول تجد جميع الخدمات و التوصيات متاحة تحياتى لك و تمنياتى بمزيد من الارباح  |

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#262

|

|

|

|

|

جميع المشاركات هنا من مواقع البنوك مباشرة و هى تتطلب الاشتراك و تسجيل الدخول رابط موقع الدراسات و الابحاث و خدمات كبار المستثمرين من بنك بى ان باريبا Login / Register بعد تسجيل الدخول تجد جميع الخدمات و التوصيات متاحة تحياتى لك و تمنياتى بمزيد من الارباح  |

|

|

المشاركة رقم: 263 | |||||||||||||||||||||||||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

اخي من خلال تجربتك ما نسبة نجاح التوصيات |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

#263

|

|||||||||||||||||||||

|

|||||||||||||||||||||

اخي من خلال تجربتك ما نسبة نجاح التوصيات |

|||||||||||||||||||||

|

|

المشاركة رقم: 264 | |||||||||||||||||||||||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

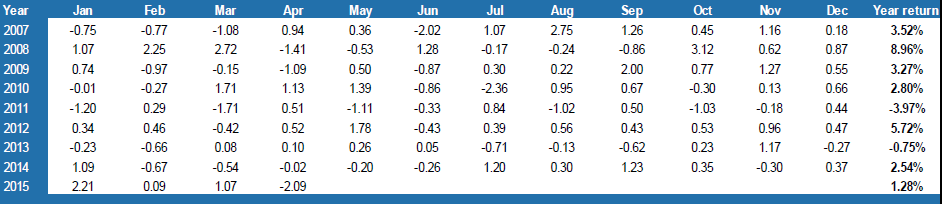

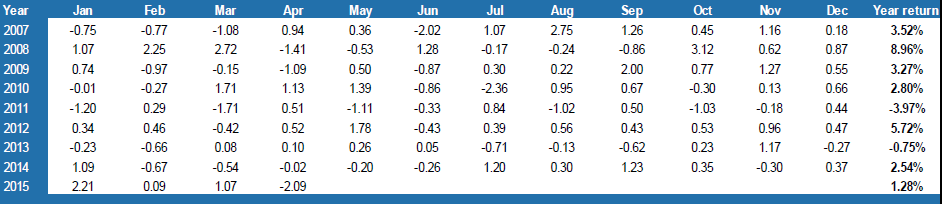

تفضل أخى الفاضل أداء واحدة من المحافظ الاستثمارية لبنك مورجان ستانلى بداية من شهر يناير 2007 و حتى شهر أبريل 2015  حجم الصفقة الواحدة هو 10 مليون دولار فى الغالب احكم بنفسك المصدر : بنك مورجان ستانلى و الرابط: Email Authentication شخصيا لا أستخدم توصيات البنوك للتداول المباشر و انما استفيد منها بطرق أخرى متعددة |

|||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

#264

|

|||||||||||||||||||||

|

|||||||||||||||||||||

تفضل أخى الفاضل أداء واحدة من المحافظ الاستثمارية لبنك مورجان ستانلى بداية من شهر يناير 2007 و حتى شهر أبريل 2015  حجم الصفقة الواحدة هو 10 مليون دولار فى الغالب احكم بنفسك المصدر : بنك مورجان ستانلى و الرابط: Email Authentication شخصيا لا أستخدم توصيات البنوك للتداول المباشر و انما استفيد منها بطرق أخرى متعددة |

|||||||||||||||||||||

|

|

المشاركة رقم: 265 | |||||||||||||||||||||||||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

#265

|

|||||||||||||||||||||

|

|||||||||||||||||||||

|

|||||||||||||||||||||

|

|

المشاركة رقم: 266 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#266

|

|

|

|

|

|

|

|

المشاركة رقم: 267 | |||||||||||||||||||||||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

Email Authentication |

|||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

#267

|

|||||||||||||||||||||

|

|||||||||||||||||||||

Email Authentication |

|||||||||||||||||||||

|

|

المشاركة رقم: 268 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

[COLOR="Blue"] |

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#268

|

|

|

|

|

[COLOR="Blue"]

نظرة على سوق العملات للأسبوع القادم " يبدأ من الغد" من أحد مديرى صناديق التحوط Note that this is my current view, but if market conditions change my view can change too. Generally I will trade in alignment with what I have noted here, though I will wait for a set-up before I enter. I base my view on technical and fundamental information. This is my beliefs and you are welcome to have opposite ones. Having a plan is more important than the actual direction for me. Short GBP/USD. Reversal – MT is a normal bull. But we have a strong bearish pin candle on the weekly chart, heavily selling on negative data and the election coming up. Waiting USD/JPY. – MT is sideways normal. Range continues to hold. Short AUD/USD Reversal – MT is sideways normal. Bearish weekly pin candle off resistance, and selling on positive news suggests the opportunities are short. Will depend a bit on the RBA though. Long EUR/USD. Trend – MT is bull normal. I think better opportunities on the crosses this week. Short NZD/USD. Reversal– MT is sideways normal. Selling signals on daily and weekly charts. Short USD/CHF. Short – MT is bear normal. Watch out for a bullish day on Monday in combo with Fridays spinning top. Waiting EUR/CHF. – MT is bear normal. But turning sideways normal so prefer to wait. Waiting USD/CAD. – MT is bear normal. But weekly signals are bullish. Long EUR/GBP. Trend – MT is fast bull. Think there may be more upside here. Short AUD/JPY. MT is sideways volatile. Got the short reversal off the edge we have been waiting for. Waiting NZD/JPY – MT is sideways normal. Wait for now. Waiting GBP/JPY. – MT is bull normal. But careful after a bearish pin candle and the election this week. Long EUR/JPY. Trend – MT is bull normal. This could be a good play. Waiting GBP/NZD. – MT is just bull normal. But reversing and the election coming up makes me careful. Long EUR/NZD. Trend- MT is fast bull. Could be a decent buy the dip opportunity. Long AUD/NZD. Trend– MT is normal bull. But the pin candle on daily chart on Thursday means trade with caution. Long EUR/AUD. Reversal – MT is fast bull. Great reversal pattern on Wednesday provided a good buying opportunity. Short GBP/AUD. Reversal – MT is sideways normal. Bearish engulfing off resistance provides a low conviction short Waiting AUD/CAD. Trend– MT is sideways normal. Wait. Short GBP/CAD. Trend– MT is bear normal. Nice candle stick patterns indicating a selling opportunity here. Waiting EUR/CAD. Trend -MT is bear volatile. Wait and see. /COLOR] |

|

|

المشاركة رقم: 269 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#269

|

|

|

|

|

تعليق بنك أر بى اس على الأحداث المهمة للأسبوع القادم " بداية من الغد" United States At least for the USD, April showers have tended to yield May flowers in recent years. After falling in six consecutive Aprils including 2015, the DXY has rebounded strongly in each of the past five years in May, though developments in the Euro-area periphery crisis and ECB policy action have played a role in several of those May USD rebounds. The moderation in US data appears to have been more broad-based than most anticipated, and the recent sell-off in the USD likely reflects in part a loss of confidence in the view that the economy rebounds in the spring. Our economists expect a solid bounce-back in US April employment, which could be a positive for the reeling USD. We remain strategically positive on the USD, largely because we think the US data will indeed begin to recover as soon as next week and that the FOMC will ultimately gain reasonable confidence needed to hike the Fed Funds rate later this year (base case September). Fed Chair Yellen is scheduled to speak on a panel alongside IMF head Lagarde. The FOMC statement noted a downgrade in the recent data but did not clearly indicate that the FOMC sees new downside risks to the outlook, noting that the weakness in the economy is likely due in part to transitory factors. Chair Yellen highlights the plethora of FOMC speakers next week that may flesh out the current views on the FOMC in greater detail than did the statement. The US trade balance for March is due, and with a heightened focus on the strength of the USD and its impact on the economy we anticipate the monthly trade figures should garner interest. These will be the first trade figures released since the resolution of the West Coast port strike. Euro-area For EUR/USD, the short-term unwind of carry positions funded in EUR along with a further sell-off in European fixed income may prove a larger driver of the cross than the US data. That may keep EUR/USD sticky even if the US data improve, though we agree with our Rates Research Team that thinks there are plenty of reasons to fade the correction in European FI. We see the risks around European QE as on the upside rather than on the downside – i.e. higher risk of more bond purchases than an early taper, despite recent upside in data. At least in the near-term, a sticky EUR/USD may make GBP or JPY shorts more attractive as ways to express a stronger USD view on more positive US data. The ECB has long noted that the decline in EUR/USD was related to a divergent stance in monetary policy outlooks, as the ECB is actively easing policy via its asset purchases and the FOMC still signalling that rate hikes are likely later this year. The trade-weighted EUR has rebounded off the lows but remains very low on a historical trade-weighted basis, thus it is perhaps unlikely that the ECB speakers, including vice Chair Constancio next week, begin to more forcefully talk down the EUR. Nevertheless, this risk will likely increase should the EUR positioning squeeze continue. On the data calendar, services and composite PMIs across the Euro-area are released and German trade and retail sales figures for March are due as well. UK The UK general election on May 7th appears likely to result in a hung parliament, with neither Labour nor the Conservatives likely to secure a majority. We think the risks to the UK economic outlook lie on the downside relative to consensus, and the political gridlock that may result could weigh on investment intentions and business confidence. That risk may be under-appreciated and could keep the Bank of England more accommodative for longer. In their preview, our economists cite the 10PM local time exit polls as potentially crucial, given the accuracy seen in exit polling in the previous two elections. (Note – our economists preview is a product of Independent Research) The April services PMI is the key UK data point released next week. Australia and New Zealand The RBA has suggested repeatedly that “further easing of policy may be appropriate over the period ahead”, which is a surprisingly blunt assessment from the central bank and suggests easing is likely in the coming months. Still, in an April 21st speech, Governor Stevens expressed a lessened enthusiasm about the value of additional rate cuts given the already high level of leverage in the economy. That, paired with inflation holding essentially steady in 1Q 2015 (and in line with the RBA’s last forecast round), stronger than expected employment data in March, and a small pickup in iron ore prices makes this week’s RBA decision a close call. The recent data may support a wait-and-see stance to assess the housing market in light of December macro prudential measures, but the decision accompanies a forecast update in the new Statement on Monetary Policy, a 25bp cut at this meeting is certainly not out of the question. The Australia data calendar also includes April employment data. The RBNZ delivered a more clearly dovish statement following their April meeting, suggesting that rate hikes are not currently being considered. Importantly, however, the statement does not suggest that rate cuts are being considered at this time either, instead saying that it would be appropriate “if demand weakens, and wage and price-setting outcomes settle at levels lower than is consistent with the inflation target.” First quarter employment statistics are released next week and with a direct reference to wage inflation as one of the factors the RBNZ is watching, the quarterly average hourly earnings should be a focus. The y/y rate of average hourly earnings, at 3.0% y/y as of 4Q 2014, is just below the average rate since 1990 (3.2%) but well below the 5-6% y/y levels seen in 2005-2008. |

|

|

المشاركة رقم: 270 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#270

|

|

|

|

|

رؤية و تحليل بنك باركليز لهذا الاسبوع بالاضافة الى صفقة الأسبوع بنقاط الدخول و الاهداف و الوقف USD: Back in business Improving US data are likely to halt recent USD weakness and support a return of trend USD appreciation. Disappointing US data and dovish FOMC March forecast revisions, in the context of extremely long USD positioning, have dragged the trade-weighted USD 3.5% lower from its mid-March highs and moderated market expectations of the Fed’s tightening cycle (Figure 1). While last week’s Q1 GDP growth of just 0.2% q/q epitomised the recent activity weakness, our US economists think that much of this is related to bad weather and some of the lost output should be made up in Q2 (Barclays’ forecast: 3.0% q/q saar). In the context of continued improvement in the US labor market, which is likely to be confirmed by this Friday’s April US labor market report, we think that the Fed is likely to raise rates at its September meeting (less than 50% priced) and USD appreciation should shortly resume (Figure 2). We forecast April NFP to rise by 250k (consensus: 230k), the unemployment rate to fall to 5.4% (consensus: 5.4%) and average hourly earnings of 2.4% y/y (consensus: 2.3 %). Central bank action will likely continue to be an important driver of currency performance. Solid euro area economic data and incrementally positive news related to Greece’s negotiations with its creditors contributed to a partial unwind of ECB QE-related trades last week. EURUSD and core euro area bond yields moved higher and European equities fell. However, there remains a particularly large amount of slack in the euro area economy and the ECB is committed to a long period of low or negative nominal yields. The combination of these factors should keep real returns to capital poor and keep downward pressure on the EUR. Our rates strategists think that the recent rise in euro area yields represent a healthy positioning/liquidity-led correction rather than a fundamental change (Global Rates Weekly: Reality check, 30 April 2015). Elsewhere, the recent recovery of oil prices has allowed monetary policy makers to pause for thought but small open-economy central banks continue to face challenging outlooks that likely require further adjustment in policy settings. After hiking 100bp through the first half of last year, the RBNZ last week adopted an easing bias in response to extremely low core inflation, in part driven by unjustified NZD strength. The AUD is likely to come under downward pressure this week. We expect the RBA to cut its policy rate by 25bp at its Tuesday meeting (market pricing: 17bp of cuts) to 2.00%, given a weak outlook for business investment and the widening gap between the real exchange rate and the terms of trade, a message which is likely to be reiterated in Friday’s (quarterly) RBA Statement on Monetary Policy. As such, we recommend being short AUDUSD this week, a trade which is also supported by strong seasonal selling of AUDUSD in May (see below). Thursday’s UK general election should weigh on GBP as political uncertainty is confirmed. The latest seat projections (e.g. those from Election Forecast, May 2015, Elections Etc, the Guardian and YouGov) continue to suggest that a hung parliament is the most likely outcome and that neither of the major parties will be able to form a majority with less than two coalition partners. Exit polls will be published once polling booths close at 10pm UK time on Thursday and Press Association forecasts suggest that most of the official individual constituency results will be released by 6am London time on Friday and all results should be known by early Friday afternoon. However, clarity is unlikely. The results are likely to confirm a highly uncertain political picture and support our view of a prolonged period of coalition negotiation (see Global Economics Weekly, 1 May 2015). This political uncertainty should be compounded by fundamental differences between Labor and Conservative views on important institutional risks, EU membership and Scotland’s independence. However, GBP relative implied volatility remains around the same level it was prior to the more-certain 2010 election and represents a mispricing of upcoming political risk, in our view. Trade for the week ahead: Short AUDUSD An under-priced RBA rate cut and strong US labor market report should push AUDUSD lower this week. In addition, our technical strategists are bearish AUDUSD. Last Wednesday’s topping candle has capped recent corrective gains and was confirmed by subsequent selling into the end of last week (Figure 3). Seasonal studies (see Technical Strategy: May Seasonal Chart Pack) highlight May as being the most negative for AUDUSD versus its major currency peers and the most bearish month of the year for AUDUSD as measured by median and mean returns (Figure 4). This adds to our conviction for a move lower towards initial targets in the 0.7680 area. A move below the 0.7530 range lows would signal further downside towards our greater targets near 0.7100. What to look for next week USD: Data to support a reversal of recent USD weakness After the winter slump, a more constructive economy and rising inflation pressures are starting to be priced by US fixed income markets. The recent backup in US rates has been driven mainly by higher real rates but also higher inflation breakevens. Of the roughly 18bp move in 5y5y nominal rates since mid April about 11bp has been in 5y5y real rates and the remaining 7bp the 5y5y inflation breakeven. A Fed that sees the Q1 slowdown as transitory amid rising inflation pressures (jobless claims at 15 year lows and a rebound in the employment cost) and too little priced by way of rate hikes in 2015 (a little less than one priced by December and only a 36% probability priced for September), implies that risk reward favors higher rates and a stronger USD. We believe that data this week could serve as such a trigger. Payrolls data will be the key event on Friday. We are looking for a 250k headline print, significantly above the consensus forecast of 230k. Furthermore, we expect the tightening in labor markets to continue with the unemployment rate declining to 5.4% (c.f. 5.4%) and average hourly earnings rising 0.3% m/m (c.f. 0.2% m/m). Other data to look for include the factory orders (Monday), ISM non-manufacturing index (Tuesday) and unit labor costs (Wednesday). We are slightly below consensus on the factory orders report (2% m/m increase vs. c.f. 2.2%) and ISM non-manufacturing (56.0 vs. c.f. 56.2) but expecting an above consensus print for unit labor costs (3.8% q/q vs. c.f. 3.6%). EUR: Activity data to weigh on the currency amid continued Greece concern Euro area data this week are likely to weigh on the EUR amid continued Greece concern ahead of upcoming payments (see Macro Daily Focus: Scenarios for Greece, 27 April 2015). We forecast final April euro area manufacturing and services PMIs (Monday and Wednesday) to be confirmed at 51.9 and 53.7, respectively, in line with consensus (see Figure 5 for individual country forecasts). In Germany, factory orders (Thursday) are likely to increase 0.5% m/m in March (consensus: +1.5%), while industrial production is also likely to disappoint (Barclays: -0.2% m/m; consensus: +0.4%). We forecast similar disappointments in French (Thursday) and Italian (Friday) March industrial production of -0.4% m/m (consensus: 0.1%) and 0.2% m/m (consensus: 0.3%), respectively. GBP: UK general election to weigh on GBP as political uncertainty is confirmed As noted above, Thursday’s UK general election should weigh on GBP as political uncertainty is confirmed. The latest seat projections (e.g. those from Election Forecast, May 2015, Elections Etc, the Guardian and YouGov) continue to suggest that a hung parliament is the most likely outcome and that neither of the major parties will be able to form a majority with less than two coalition partners. Exit polls will be published once official polling booths close at 10pm UK time on Thursday and Press Association forecasts suggest most of the official individual constituency results will be released by 6am London time on Friday and all results should be known by early Friday afternoon. However, clarity is unlikely. The results are likely to confirm a highly uncertain political picture and support our view of a prolonged period of coalition negotiation (see Global Economics Weekly, 1 May 2015). This political uncertainty should be compounded by fundamental differences between Labor and Conservative views on important institutional risks, EU membership and Scotland’s independence. However, GBP relative implied volatility remains around the same level it was prior to the more-certain 2010 election and represents a mispricing of upcoming political risk, in our view. Elsewhere, April construction and services PMIs will be released on Tuesday and Wednesday, respectively, likely providing further downward pressure on GBP. The consensus forecast is expecting the construction PMI to drop to 57.3 from 57.8 while the services PMI is likely to decline to 57.5 (consensus: 58.6; last: 58.9). CAD: Labor market data in focus A more constructive message from the BoC and a rebound in oil prices has caused the market has mostly price out rate cuts from the BoC over the past two weeks. Economic data remains patchy however, e.g. the RBC manufacturing PMI for April remaining close to its recent low. As such, we believe the short squeeze in the CAD is over and the market will re-evaluate any potential future BoC move based on incoming data. Canadian employment data at the end of the week provides one such opportunity. Additionally, we believe a significant re-pricing in the front end of the US rate curve (higher) will likely to push USDCAD higher from current subdued levels. NOK: Norges on hold for now, upward pressure to the NOK expected in the short-term We narrowly expect the Norges Bank to keep its deposit rate unchanged (Thursday) and preserve its “wait-and-see” stance. We expect upward pressure to the NOK as a result and a further re-pricing of the short-end of the NOK rates curve. We identify three reasons that support an unchanged outcome at this juncture. Firstly, contrary to our expectations, oil prices have rebounded since the January lows, likely allowing the Norges Bank to maintain its patient stance if it judges that near term risks to output have de-escalated somewhat. Secondly, similar to its March meeting, the Norges Bank will likely be reluctant to cut rates further given growing financial stability concerns, which seem to directly enter the Norges reaction function. Finally, the global easing cycle seems to have paused for now, implying somewhat higher foreign real interest rates compared to the March projections and narrower real interest rate differentials. To the extent this places downward pressure on the NOK going forward, there is likely to be less need for a lower policy rate to ensure monetary conditions remain accommodative. Looking ahead, we still see increased likelihood of a cut in 2015 particularly if Q1 data disappoint current Norges Bank projections (see Norges preview: A complicated reaction function, 1 May 2015 for further details). SEK: Riksbank executive board meeting and growth indicators to take centre stage The Riksbank decided to ease policy further last week by expanding the size of its QE program by SEK40-50bn, despite keeping its repo rate unchanged at -0.25% (see Riksbank on hold: Play the range in EURSEK, 29 April 2015). The subsequent SEK appreciation has led several participants to speculate over further action as early as Friday’s meeting of the executive board of the Riksbank. It was in a similar meeting that the Riksbank decided to unexpectedly ease policy in March, on the basis of a strong SEK. Nonetheless, we assign a very low probability to something similar happening next week. Yet, given the Riksbank’s recent rhetoric for a weak SEK, we think further measures, which may include FX interventions, are very likely if SEK sustains a rally in the coming weeks. We expect EURSEK to stay range-bound as the Riksbank likely will respond to unwanted SEK appreciation with further easing, but ECB policies likely will cap EURSEK topside. On the data front, April Manufacturing PMI data (Monday) and Industrial Production data (Tuesday) are likely to gain attention, consistent with our view of solid growth fundamentals. CHF: Negative prices to persist as FX reserve data to come in focus CPI inflation data (Friday) will be the next key data point for the CHF and is widely expected to confirm sustained deflationary pressures in Switzerland, owing to an overvalued and still appreciating CHF. Moreover, after having released their Q1 2015 currency allocations last week, the SNB’s April FX reserve data (Thursday) and weekly sight deposits data (Monday) will also likely be closely followed, giving an indication of the level of FX interventions. As we noted in SNB adds pressure on the CHF, 22 April 2015, we re-iterate our view that further measures in the form of FX interventions and further interest rate cuts may be used under a scenario of a sustained CHF rally. Australia: AUD to underperform as the RBA is likely to cut rates and retain an easing bias We narrowly expect the RBA to cut rates by 25bp to a new record low of 2.00% (Tuesday; market pricing: -17bp; consensus: -25bp). The RBA has a strong easing bias, recently made clear by Governor Stevens’ in a New York speech, and we expect further easing to reflect concern over the investment outlook and the widening gap between the real exchange rate and the terms of trade. We are mindful, though, that the RBA held fire in March and April and that the strength of housing, together with sticky underlying inflation and better labor market data, may give it pause for thought. Regardless, we expect the RBA to retain an easing bias to maintain downward pressure on the exchange rate. The RBA issues an updated Statement on Monetary Policy on Friday and we see some risk that it will trim its outlook for growth given concerns over non-mining investment, while the forecast profile for underlying inflation might be bumped up a little in the near term. Data-wise, we see a solid rise in retail sales in March (Wednesday; Barclays: 0.6%m/m; consensus: 0.4%) and a solid increase in real sales in Q1 (Barclays: 0.7% q/q; consensus: 0.8%). We also anticipate a solid rise in April jobs (Wednesday; Barclays: +20k; consensus: 3k) and steady unemployment (Wednesday; Barclays: 6.1%; consensus: 6.2%) with the March trade deficit narrowing (Tuesday; Barclays and consensus: AUD-1bn; last: AUD-1.2bn) and March building approvals falling further (Monday; Barclays: -3% m/m; consensus: -1.5%). المصدر : Barclays Live - Login |

|

| مواقع النشر (المفضلة) |

| الكلمات الدلالية (Tags) |

| التداول, الحيتان, الكبار, بعيون, صفقات |

|

|