اخي العزيز صاحب الموضوع لقد استفدت من المعلومات التي تقدمها ونشكر لك الجهد الذي تبذله في فائدة المتداولين وارجو ان تتحمل وتطلب الاجر من الله لبذلك هذه الفائدة والتعب في جلبها ولك خالص الشكر والتقدير ونتمنى منك الاستمرار

FX-Arabia

|

|

جديد المواضيع |

لوحة التحكم

روابط هامة

|

||||||

| منتدى تداول العملات العالمية العام (الفوركس) Forex منتدى العملات العام Forex فى هذا القسم يتم مناقشه كل ما يتعلق بـسوق تداول العملات العالمية الفوركس و مناقشة طرق التحليل المختلفة و تحليل المعادن , الذهب ، الفضة ، البترول من خلال تحليل فني ، تحليل اساسي ،اخبار اقتصادية متجددة ، تحليل رقمى ، مسابقات متعددة ، توصيات ، تحليلات ، التداول ، استراتيجيات مختلفة ، توصيات فوركس ، بورصة العملات ، الفوركس ، تجارة الفوركس ، يورو دولار ، باوند دولار ، بونص فوركس ، تداول ، اسهم ، عملات ، افضل موقع فوركس |

|

|

|

أدوات الموضوع |

|

|

المشاركة رقم: 231 | ||||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||

|

#231

|

|

|

|

|

اخي العزيز صاحب الموضوع لقد استفدت من المعلومات التي تقدمها ونشكر لك الجهد الذي تبذله في فائدة المتداولين وارجو ان تتحمل وتطلب الاجر من الله لبذلك هذه الفائدة والتعب في جلبها ولك خالص الشكر والتقدير ونتمنى منك الاستمرار

|

|

|

المشاركة رقم: 232 | |||||||||||||||||||||||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

الموضوع هو اننى أريد أن أعرض البيانات مترجمة حتى يتثنى للجميع الاستفادة بها و هى تحتاج الى وقت كثير لترجمتها سأستمر فى النشر ما قدر الله لى و ان كان قد يكون بالانجليزية يمكن الاستعانة بمترجم جوجل لمن هو غير جيد بالانجليزية أو يقوم أحد الاعضاء الكرام تطوعا بترجمة المهم فى المشاركة شكرا للجميع  |

|||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

#232

|

|||||||||||||||||||||

|

|||||||||||||||||||||

الموضوع هو اننى أريد أن أعرض البيانات مترجمة حتى يتثنى للجميع الاستفادة بها و هى تحتاج الى وقت كثير لترجمتها سأستمر فى النشر ما قدر الله لى و ان كان قد يكون بالانجليزية يمكن الاستعانة بمترجم جوجل لمن هو غير جيد بالانجليزية أو يقوم أحد الاعضاء الكرام تطوعا بترجمة المهم فى المشاركة شكرا للجميع  |

|||||||||||||||||||||

|

|

المشاركة رقم: 233 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#233

|

|

|

|

|

سوسيته جنيرال {EU} Theme overnight continues to be USD length cut back with markets consolidating into the FOMC tomorrow. We've pushed through 1.0950 so far with another round of offers here into 1.1000 but the real significant resistance up at 1.1050 where we topped out last month. Down below there is some traffic on the charts into 1.0880 but the real test in our mind isnt until the 1.0750-1.08 region that the market toyed with last week. There are about 1bn of 1.0850-1.0900 rolling off today so they could weigh on the market all else equal into 10am {GB} GBPUSD continues its ascent peaking through 1.5300 earlier but we found some interbank supply into that region. From here the next level above is 1.5340-50 where some offers come into the market but we dont have a ton until 1.5380-1.5400 with talk of stops above there away from us. Down below we envision support into 1.5250 but really dont have much on the charts to the downside now until 1.5100-50. Meanwhile EURGBP chops around 7150 with some supply on the book into and right above 7200 and then there is some support into 7120-00 with some traffic on the books below there but stops likely if we break down {SZ} EURCHF has quietly rallied through last week's highs overnight and taken out some strong selling interest into 1.0450-75 here we suspect the next level of resistance lies 1.0500-25 where we understand stops lie above. This keeps USDCHF trading higher on a generally down session for the USD and for now we have avoided a meaningful test of the key 9450-9500 support. Meanwhile the 9700 resistance region (which we rejected earlier last week) week still looms large up above 15:02:49 {JN} USDJPY tested lower on the broader USD move but we filled in modest bids here into the 118.80 and hold for now. Up above you have some congestion on the charts into 11920-30 (where the 100 DMA sits) and 11980-90 where the 50 and 55DMAs sit but the real congestion regions on the charts dont come in until 121.00-20 and 121.50-122.0 up above and then 117.50 below. Expiries see a total of about 1.5bn btwn 118.75 and 119.0 {AU} AUDUSD has toyed with the idea of a break above 8000 but not managed to get through just yet as we've found local supply into 7970-80 and think there are still macros looking to play the short side on rallies (although at this point wouldnt be surprised to see stops through 8010-20). Down below 7820-40 was a pivot to the topside so we look for that region to be supportive for now. There are abt 1bn of of 7975-80s rolling off today {CA} $CAD trades down to 1.2050 but we found strong demand interbank into this region and and envision further support into 1.2020-40 (which held late last week. Up above we see some supply into 1.2200-1.2180 here but could see others happy to sell into 1.2150 which we saw as a key support on the charts on the way down. |

|

|

المشاركة رقم: 234 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#234

|

|

|

|

|

بى ان بى باريبا Long USD and NZD vs. JPY ahead of policy meetings A raft of policy announcements is due tomorrow: the FOMC, RBNZ and BoJ will take centre stage. The FOMC will be a key focus and we remain of the view that the risks are skewed to a USD friendly reaction given how little tightening is priced in over the next six months. We expect the RBNZ to leave rates on hold and think that a neutral message could bolster the NZD. We entered a short AUDNZD recommendation at 1.0225 in the past week, targeting a move down to 0.98 in the cross in addition to an existing long NZDJPY options trade. In Japan, our economists see little appetite for further easing by the BoJ despite slumping inflation expectations. Notwithstanding this, we think the risk-reward of being long USDJPY is attractive into the meeting. We added a recommendation to buy short-dated 25-delta USDJPY calls last week. |

|

|

المشاركة رقم: 235 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#235

|

|

|

|

|

بى ان بى باريبا Smoother progress in Greece will not boost the EUR Prospects for smoother Greek negotiations with creditors emerged overnight as Prime Minister Tsipras reshuffled his team that handles talks with European and IMF lenders. The move is viewed as an effort to push Finance Minister Yanis Varoufakis – often seen as brash - to a less active role in negotiations. Deputy Foreign Minister Tsakalotos is now coordinator of a new team negotiating a reforms deal with lenders. While Greece likely has sufficient means to make payments due in May and June, Greek funding needs skyrocket in July and August so the May 11 Eurogroup meeting will be a crucial date for progress on negotiations with the EU. We think the EUR’s funding-currency status implies a changing reaction function to Greek headlines as real yields drive the currency (see chart). A resolution to Greek uncertainty is likely to boost global risk appetite and weigh on the EUR. For EURUSD, the most likely catalyst for a move lower to our 1.04 target will be stronger US data not eurozone stress. We remain short EURUSD and expect the 1.09-1.10 area to continue to provide strong resistance. |

|

|

المشاركة رقم: 236 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

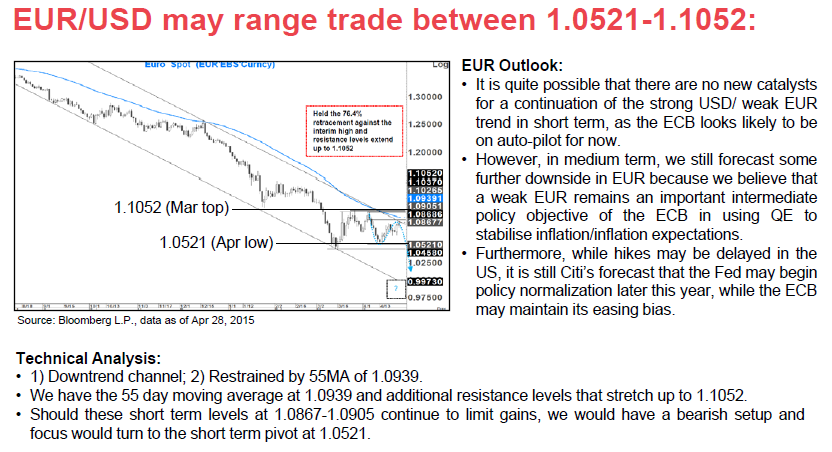

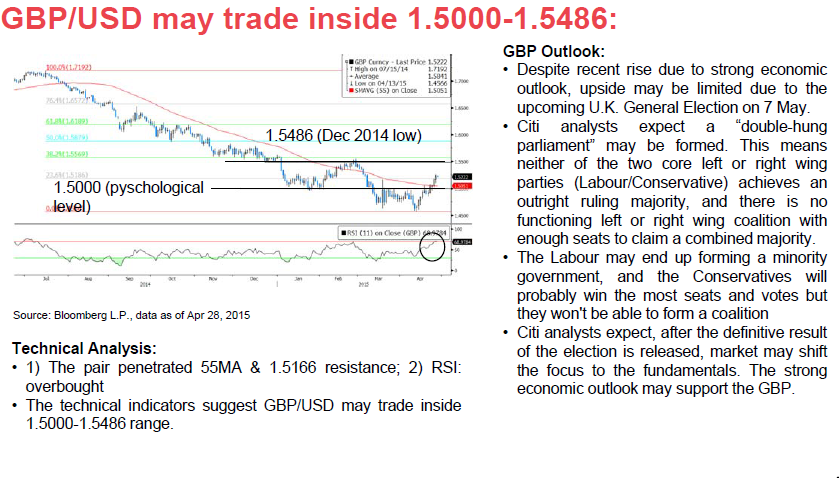

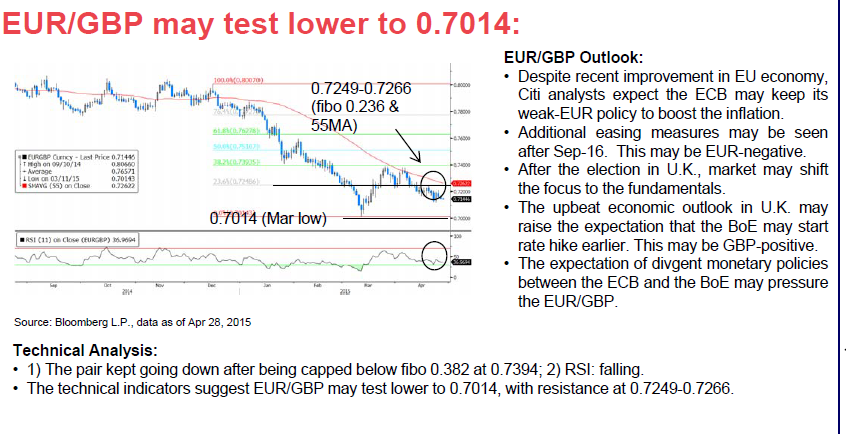

سيتى بنك |

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#236

|

|

|

|

|

سيتى بنك

Long USDCHF @ 0.9650 Stop at 0.9494 Take profit at 0.9994 |

|

|

المشاركة رقم: 237 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

سيتى بنك |

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#237

|

|

|

|

|

سيتى بنك

|

|

|

المشاركة رقم: 238 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

[COLOR="rgb(0, 191, 255)"] |

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#238

|

|

|

|

|

[COLOR="rgb(0, 191, 255)"]

دويتشه بنك عن تطورات الاوضاع اليونانية Three new developments A few more weeks have passed since our last update on Greece with little change to the status quo: stalled negotiations, an ongoing drain to the Greek government's cash position, and persistent pressure on the Greek banking system. Last Friday's Eurogroup publicly confirmed this lack of progress, attributed to both procedural difficulties and more importantly large gaps on substance. Despite this, we consider three recent developments in domestic Greek politics as finally turning a little more positive. First, opinion polls* have started to turn. After the first few weeks' honeymoon period, the electorate is turning more cautious on the administration's negotiating strategy, reflected in declining approval ratings for both the government and PM Tsipras himself. Most significantly, even as tensions rise, polls show continued and overwhelming public support for a European solution: between "rupture" or "agreement", opinion polls consistently point to more than 70% support for the latter. These trends matter because the government's political narrative has been strongly reliant on a perception of broad popular backing. As approval ratings decline, accompanied by a desire for a "European solution", so does the pressure on the government. The second development is that the government's negotiating team has been re-shuffled. Talks have suffered from the Greek government's lack of negotiating experience as well as persistent operational difficulties: the mission heads of the three institutions (formerly Troika) have been negotiating at arms' length from Brussels or Paris, with the technical teams in Athens facing ongoing difficulties in their access to data and line ministries. Officials more closely aligned to moderate deputy Prime Minister Dragasakis (including Oxford-educated deputy foreign minister Tsakalotos) have now been given a greater role, and the overall team has been expanded in size. These changes may help negotiations, but are not a game-changer: the biggest obstacle to an agreement is the distance in matters of substance, most notably collective wage bargaining, pensions, and fiscal measures for this year. Still, the change after intense pressures from Europe at the margin signals a move towards a more moderate direction, at least in terms of approach. Third, and most importantly, PM Tsipras gave a wide-ranging interview to a Greek TV news channel yesterday evening. The deadlock in terms of sticking points was confirmed, yet the PM's statements on the government's negotiating strategy were more important. When asked on the way forward if an agreement violating electoral promises is required, the Prime Minister signaled that a referendum would be his preferred route, ruling out a general election. We consider this important for two reasons. First, it signals that an agreement that crosses the government's red lines is likely being actively discussed. Second, this is the first time that the PM has provided what we consider to be an internally consistent strategy in breaking the current deadlock. [/COLOR] |

|

|

المشاركة رقم: 239 | ||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

|

||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

#239

|

|

|

|

|

دويتشه بنك عن البيانات الامريكية الصادرة غدا الاربعاء FOMC to look through weak Q1 output given sturdy income growth __________________________________________________ __________________________________________________ ____________ Deutsche Bank Securities Inc. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 148/04/2014. Wednesday Release Forecast Previous Consensus 8:30 am Real GDP (Adv Q1 15): +0.7% +2.2% +1.0% GDP deflator: +0.5% +0.1% +0.5% 10:00 am Pending home sales (Mar): +1.0% +3.1% +1.0% Source: Deutsche Bank, Bloomberg Finance LP Commentary for Wednesday: The initial print on Q1 real GDP is released this morning. These figures are highly preliminary and prone to massive revisions. Last year, the first reading on Q1 output was reported at 0.1%, only to be revised down to -1.0% one month later and then to -2.9% one month after that. Since then, Q1 2014 real GDP growth has been revised further to show a -2.1% decline. However, the figures are susceptible to further revision this July, when the Bureau of Economic Analysis releases the annual benchmark revision. History appears to be repeating, as we project just a 0.7% increase in Q1 2015 real GDP, but the risk is that it is even weaker. In our view, the economy had to deal with more adverse shocks this year relative to last. In addition to the unusually harsh winter weather, the economy had to contend with a much stronger dollar, a sharp plunge in energy capex and the West Coast port slowdown. Despite all this, employment was relatively robust last quarter, growing at a 2.2% annualized rate. This will likely be the second-consecutive quarter in which payroll growth has outpaced GDP, which has not occurred since Q2/Q3 2006. It is possible that GDP growth (specifically productivity) is being understated, because the income side of the economy has not experienced the same degree of weakness evident in the output figures. The chart below shows the annualized changes in real gross domestic income (GDI) compared to real GDP. We only focus on 2014, because the GDI data were distorted in 2013 by a change in tax policy. In Q1 2014, GDI declined -0.7% compared to a -2.1% drop in GDP. In Q2, GDI rose 4.1% versus 4.6%; in Q3, GDI was up 5.2% compared to 5.0% for GDP and then in Q4, GDI increased 3.2%, one full percentage point faster than GDP. Over the full year, GDI rose on average 50 basis points more than GDP. In our view, the GDI data are a better proxy of underlying economic activity than the GDP figures because the former are derived from withheld income tax receipts, which do not get revised. To be sure, the stronger 2014 GDI numbers are, on the surface, more consistent with the underlying trend in the labor market, which generated 3.1 million jobs last year. If we are to believe the expenditures figures, this would mean that productivity growth was unusually weak. It seems unlikely that companies would hire so many unproductive workers. Unfortunately, the GDI data have displayed the same pattern of seasonal softness as GDP, with a relatively weak Q1 followed by strength thereafter. This is another reason Fed policymakers will look through Q1 2015 GDP data, which will be evident in this afternoon’s FOMC statement. |

|

|

المشاركة رقم: 240 | ||||||||||||||||||||||||

|

كاتب الموضوع :

Зиюс

المنتدى :

منتدى تداول العملات العالمية العام (الفوركس) Forex

السلام عليكم ورحمة الله

|

||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||

|

#240

|

|

|

|

|

السلام عليكم ورحمة الله

مجهود كبير اخي جزاك الله عنا خيرا |

|

| مواقع النشر (المفضلة) |

| الكلمات الدلالية (Tags) |

| التداول, الحيتان, الكبار, بعيون, صفقات |

|

|