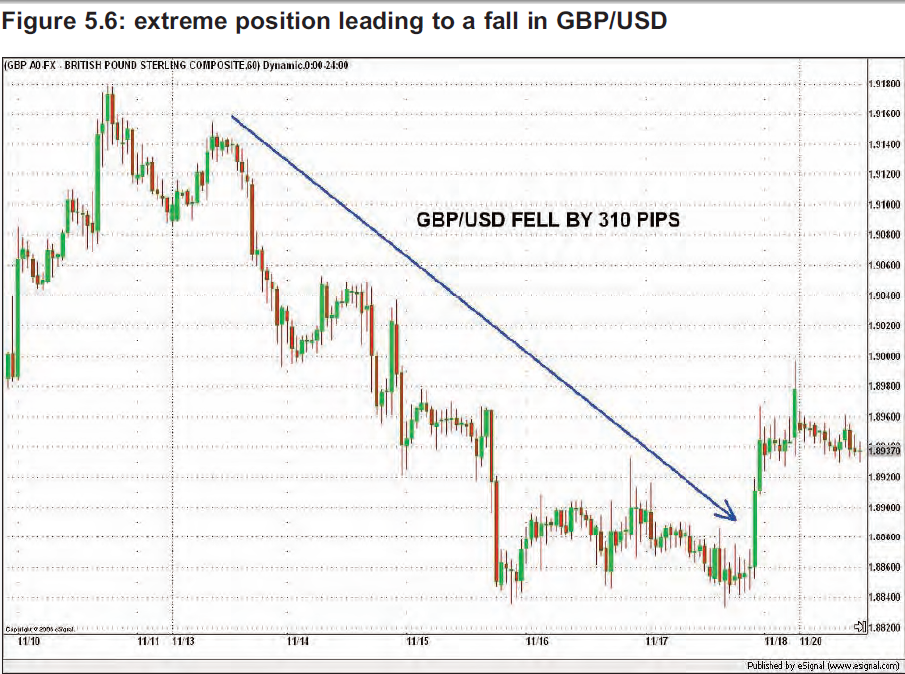

In the week following the extreme net long speculative positioning, reflected

by the COT data, GBP/USD fell by 310 pips as seen on this 60-min chart

The presence of an extreme reading allows you to be prepared for a possible trend

reversal which could occur when large speculators liquidate their positions. A mere

increase or decrease of contracts for a particular currency futures does not indicate

anything which could be of predictive value, as it simply shows you what has

happened, but not what could possibly happen in a high-probability scenario

COT data is a diamond in the rough

What deters many traders from using the COT report is its raw organisation of data

but that is not good enough an excuse to completely neglect this little treasure trove

The information from the COT report can be transferred into a spreadsheet so that

further analysis can be conducted in a more suitable format

The COT data itself is not sufficient to generate entry or exit signals, as the report

does not consist of currency price data, but it can generate warning signals of a

possible turn ahead in the spot forex market, and can be used to optimise other

trading strategies you may have so that maximum profits can be reaped from the

market. Analysis of the COT report does not always throw up trading opportunities

in the spot forex market, but when it does, you will be better prepared for a

potential turn of tide, and be more confident in your trades. Even though entries and

exits cannot be timed solely based on the COT data, it can be an extremely useful

.tool to have in your toolbox to gauge the overall market sentiment

2Market’s reactions to news

يتبع..