Using extreme positioning

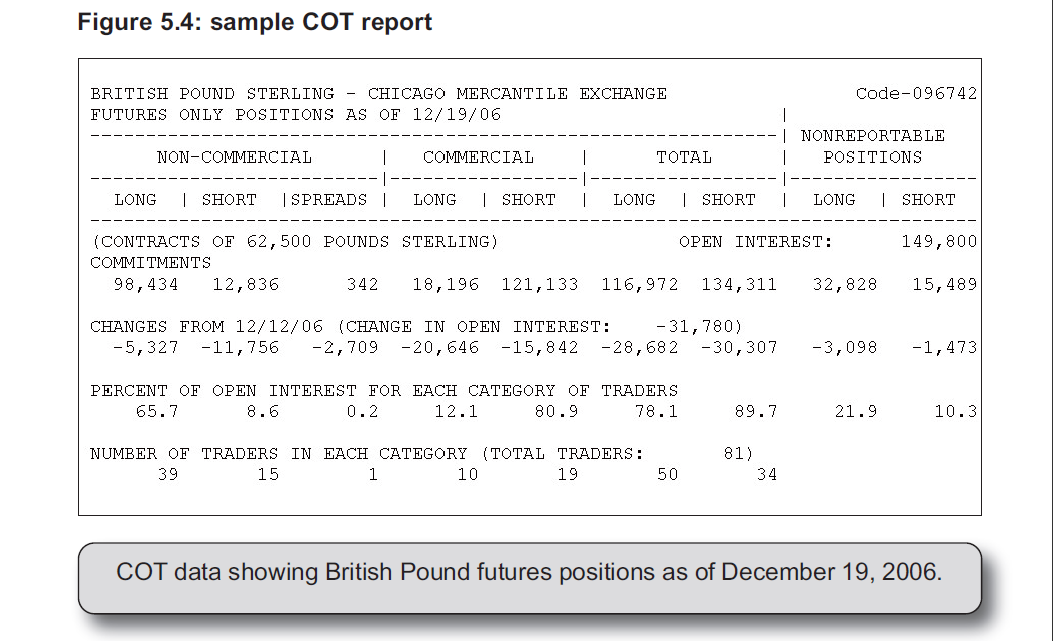

In the COT report, under each type of currency futures, you can see that the total

contract volume in each category is split up between “long”, “short” and “spreads”

of which the first two are relevant to our analysis. What is of concern to us is

whether the non-commercials are net long or short in that currency futures

In order to determine the volume of contracts that these large speculators are

holding net long or short positions of for that particular currency futures, you just

need to calculate the difference between the longs and shorts, that is, subtract the

number of short contracts from the number of long contracts. A positive figure

shows the number of net long contracts, while a negative figure shows the number

of net short contracts

As you can see in Figure 5.4, the open interest for GBP futures on Tuesday December

19, 2006, was 149,800 contracts which was a decrease of 31,780 contracts from the

previous week. The non-commercials are long 98,434 contracts and short 12,836

(contracts. Therefore, they are overall net long 85,598 contracts (98434 - 12836