Ways of Measuring Market Sentiment

The mood of the market depends mainly on what the majority of traders think about

the current market situation. But how can you get an idea of the overall sentiment

of the market? You can do so by reading reports by analysts and financial

journalists in news wires or by visiting online trading forums to see what other

traders are discussing. However, these ways of getting a feel of the current market

sentiment are not too accurate; you may think that other traders are in a buying or

selling mood, but that may not be what is really happening in reality. Here are some

:of the more effective ways of gauging market sentiment

1The Commitment of Traders (COT) report

2The market’s reactions to news releases

These are explained in more details below

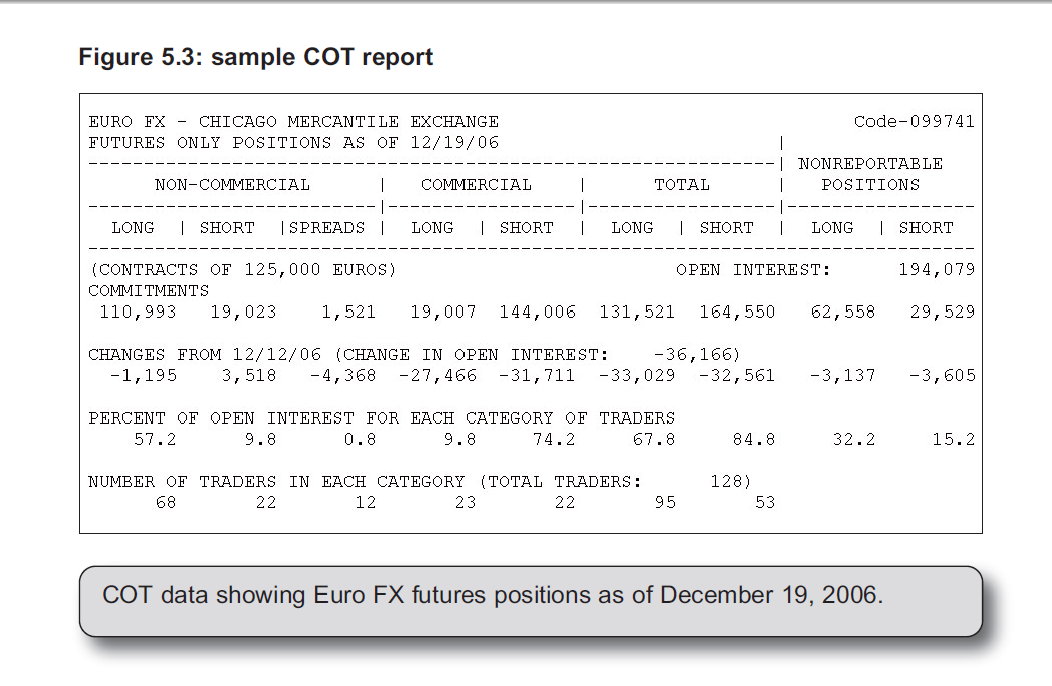

1Commitment Of Traders (COT) report

?What is the COT

The COT report provides traders with detailed positioning information about the

futures market, and is, in my opinion, one of the most underrated tools that forex

traders can make use of to enhance their trading performance

The report is compiled and released weekly by the Commodity Futures Trading

Commission (CFTC) in the United States every Friday at 15:30 Eastern Time, and

records open interest information about the futures market based on the previous

Tuesday. Anyone can access the COT report for free on the CFTC website

(www.cftc.gov/cftc/cftccotreports.htm)

There are basically two types of reports available: the futures-only COT report and

the futures-and-options-combined COT report. I usually just access the futuresonly

report for a glimpse of what has happened in the futures dimension of the

forex market. In order to get through to the currency futures data, you have to wade

past other commodities like milk, feeder cattle and so on, so a little patience is

required

Even though the data arrives three days late, the information nonetheless can be

helpful since many traders spend their weekend analyzing the COT report. The time

lag between reporting and release is the main handicap of the COT data, but despite

this limitation, you can still use it as a sentiment tool

(Figure 5.3 shows a page from the December 19, 2006, COT report (short format

displaying data for the Chicago Mercantile Exchange’s Euro FX futures contract

You can see the long and short positions held by traders in each of the three main

categories defined by the CFTC, as explained below

يتبع..

يتبع..