When forex traders anticipate this kind of situation, they become more inclined to

buy that high-interest-rate currency as well, knowing that there is likely to be

massive buying interest for that currency

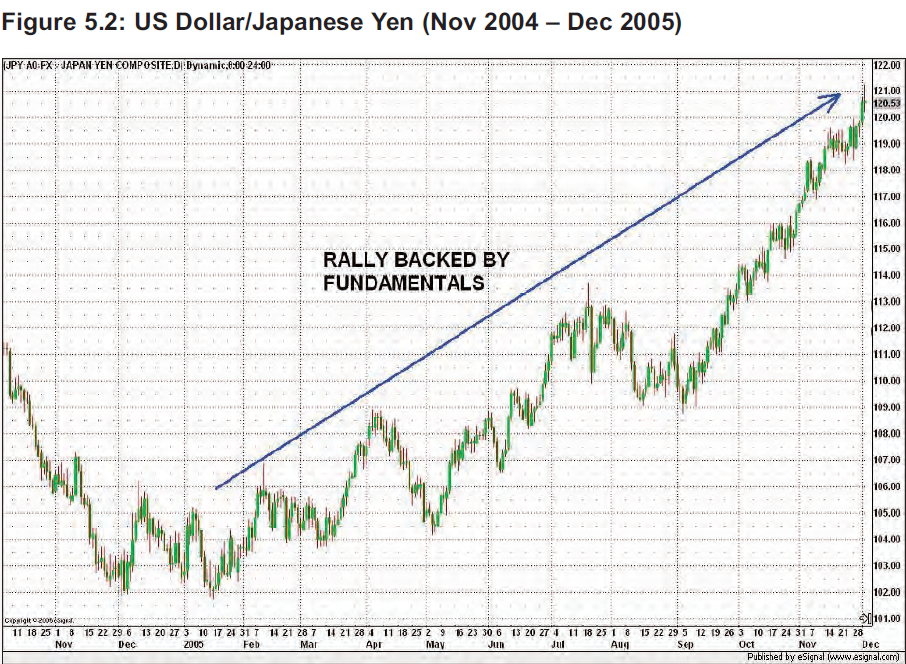

For example, if the Fed announces a series of interest rate hikes in the US, whereas

the Bank of Japan has no intention to raise rates in Japan, there is bound to be more

buying interest for USD/JPY, thus pushing up the US dollar against the Japanese

yen, and even possibly against other currencies as well. This situation occurred in

2005, which caused USD/JPY to rally around 1900 pips from the start of the year

to December 2005, as you can see from Figure 5.2. This divergence in monetary

policy between the US and Japan had created a very bullish US dollar sentiment in

the market, attracting more and more traders to long USD/JPY

So, in general, rising interest rates in a country should boost the market sentiment

regarding the currency of that country

The opposite is true too: when interest rates are cut in a country, that would result

in quite a bearish sentiment regarding the currency of that country, and traders

.would be more willing to sell than buy that particular currency